Order Confirmation or Receipt

Provide a copy of the order confirmation or receipt showing transaction details: date, item/service purchased, and amount paid.

------------------------

------------------------

------------------------

------------------------

------------------------

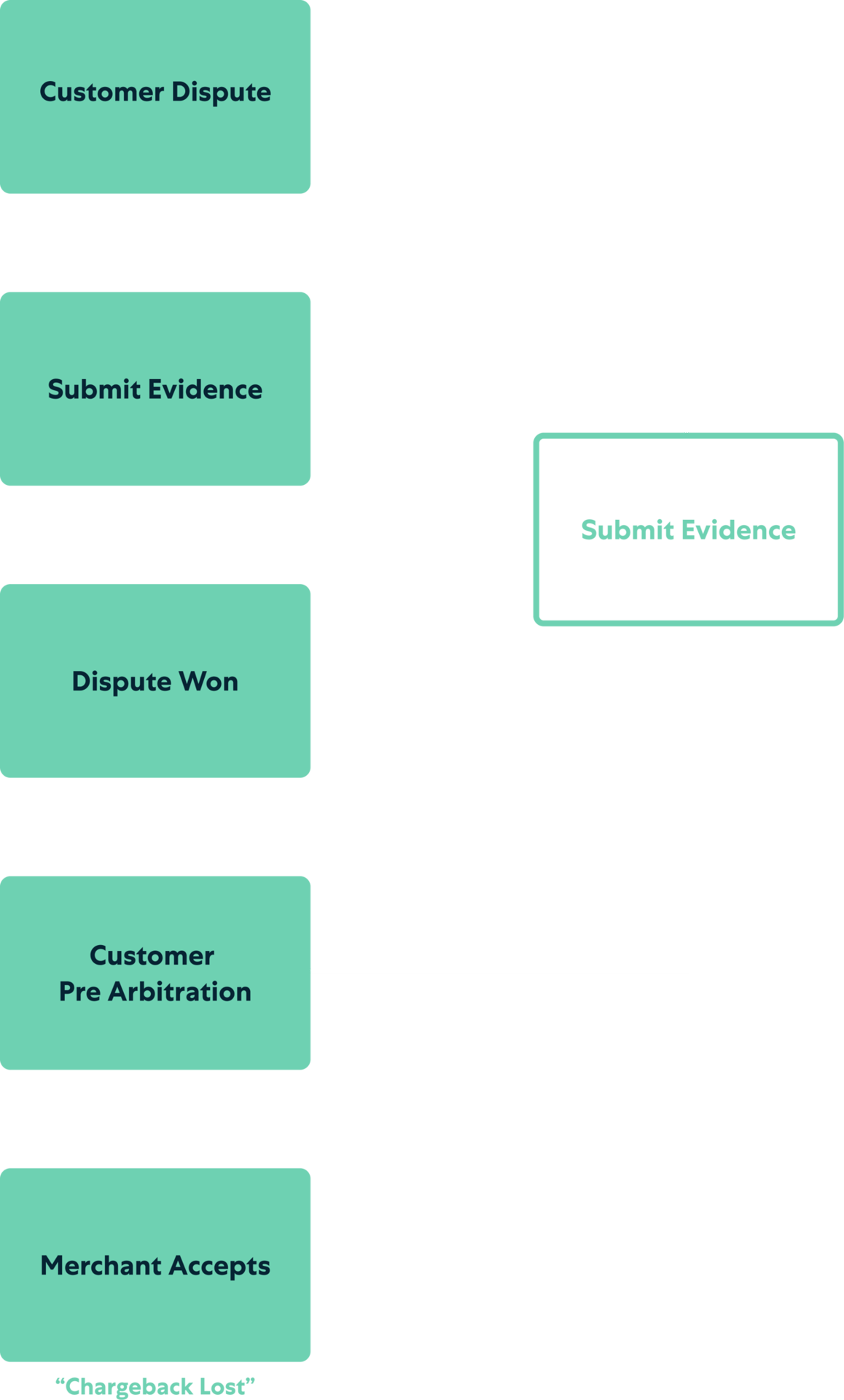

By arming yourself with these tips, you can lower your chargeback count. This will save you time, money and guard your profits.